Indiana County Real Estate Records

Register of Wills & Recorder of Deeds & Clerk of Orphans Court

Our 2026 new price lists for Register of Wills will be posted soon. Marriage License Applications: YOU MUST MAKE AN APPOINTMENT and bring the online filled out ...

https://www.indianacountypa.gov/departments/register-and-recorder/Official Record Search - Quick Search

Navigated to quick search page Your web browser is out of date. Update your browser for more security, speed and the best experience on this site. Update your browser...

https://indiana.pa.publicsearch.us/

State Property Deeds Maps & Photos - IDOA

Interactive State Property Map & Records ... Which email address on the bidder profile can I use to sign into the Supplier Portal? More FAQs. Copyright ...

https://www.in.gov/idoa/state-property-and-facilities/state-property-deeds-maps-and-photos/General Information Tax Assessment Indiana County Pennsylvania

Contact Info Indiana County Chief Assessor Frank E. Sisko Jr. Indiana County Tax Assessment Office Indiana County Courthouse Second floor 825 Philadelphia St. Indiana, PA 15701-3973 Hours: Mon-Fri 8:30am-4pm Phone: (724) 465-3812 or (724) 465-3813 Closed Holidays General Links & Information - View individual My Property information Property owners may freely review and comment on their parcel information using a control number and web password...

https://www.indianacountypa.gov/departments/tax-assessment/general-links-and-information/Assessor St. Joseph County, IN

Assessor The Assessor's Office is open to the public. We encourage you to contact the office via phone or view this website to help answer your questions. A Brief Overview of the Assessor’s Function - Reviews all assessments using the DLGF Property Assessment Guidelines.

https://www.sjcindiana.gov/173/Assessor

indy.gov: Pay Your Property Taxes or View Current Tax Bill

For taxpayers' convenience, the Treasurer's Office has designated a lockbox on the first and tenth floors to facilitate a contactless payment option. All lockbox payments must be checks; no cash payments in the lockbox. The Treasurer's Office will be open from 8am to 5:30pm on May 7th, 8th, and 11th for the May 11th, 2026 Spring Tax Deadline.

https://www.indy.gov/activity/pay-your-property-taxes-in-full

Tax Assessment - Indiana County Pennsylvania

Contact Info Indiana County Chief Assessor Frank E. Sisko Jr. Indiana County Tax Assessment Office Indiana County Courthouse Second floor 825 Philadelphia St. Indiana, PA 15701-3973 Hours: Mon-Fri 8:30am-4pm Phone: (724) 465-3812 or (724) 465-3813 Closed Holidays Welcome to the Tax Assessment Office Thank you for your interest in the Indiana County Assessment Office.

https://www.indianacountypa.gov/departments/tax-assessment/Property Search / Hendricks County, Indiana

Skip over navigation Start Content - For an aerial view of your Property, please utilize Beacon's Property Search application Beacon...

https://www.co.hendricks.in.us/topic/index.php?topicid=93&structureid=20

Indian River County Auditor - Property Search Page

Tips: How to Use Search Function Step 1: Locate the "search" bar. Step 2: Use as little info as possible to search for a property. Example 1: If the owner of a property is John Smith, start by typing in Smith and clicking search, rather than typing in the entire address.

https://www.ircpa.org/site-links/property-search-page/

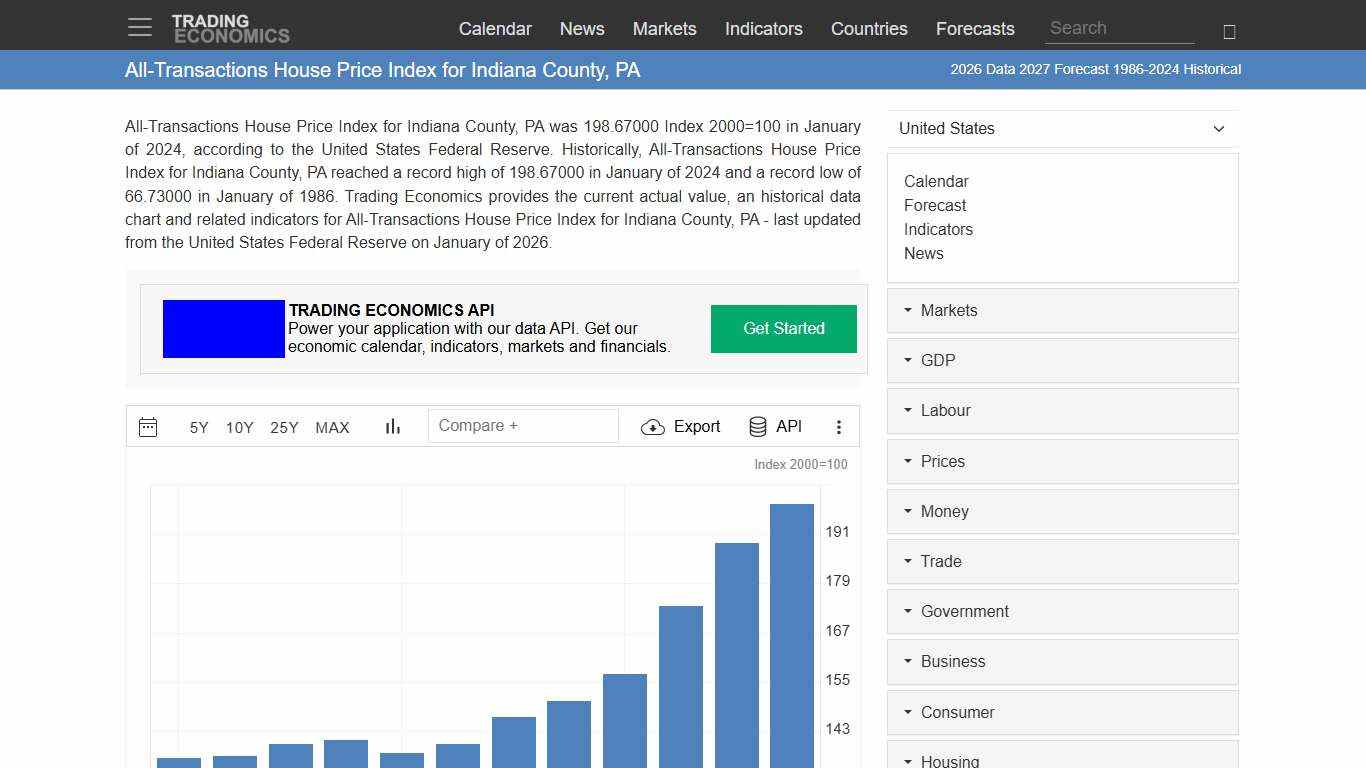

All-Transactions House Price Index for Indiana County, PA - 2026 Data 2027 Forecast 1986-2024 Historical

All-Transactions House Price Index for Indiana County, PA was 198.67000 Index 2000=100 in January of 2024, according to the United States Federal Reserve. Historically, All-Transactions House Price Index for Indiana County, PA reached a record high of 198.67000 in January of 2024 and a record low of 66.73000 in January of 1986.

https://tradingeconomics.com/united-states/all-transactions-house-price-index-for-indiana-county-pa-fed-data.html

Indiana Senate sends finalized local property, income tax plan to governor • Indiana Capital Chronicle

0:54 News Story Indiana Senate sends finalized local property, income tax plan to governor Gov. Mike Braun previously wavered on the legislation but said early Tuesday he plans to sign it into law. Shortly after midnight Tuesday, Indiana Senate Republicans agreed to significant changes in an immense local property and income tax plan — avoiding risky negotiations in favor of sending it to Gov.

https://indianacapitalchronicle.com/2025/04/15/indiana-senate-sends-finalized-local-property-income-tax-plan-to-governor/

Indiana public records access law to get anti-bot overhaul

As local units of government report an influx of time-consuming public records requests they suspect of being phishing attempts, Hoosier lawmakers are cracking down. “This bill addresses a real and emerging threat that is happening largely out of public view,” said John Wilson, representing the Allen County Board of Commissioners.

https://www.ipm.org/news/2026-01-22/indiana-public-records-access-law-to-get-anti-bot-overhaul

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities – ITEP

In 2025, local governments faced new costs and challenges brought on by unprecedented federal funding cuts and the continuation of deep state tax cuts. Following the passage of President Trump’s “One Big Beautiful Bill Act” signed into law in July 2025, local communities grappled with the implications of major federal rollbacks to Medicaid and food assistance.

https://itep.org/local-governments-are-increasingly-strapped-2026-will-bring-new-challenges-and-new-opportunities/

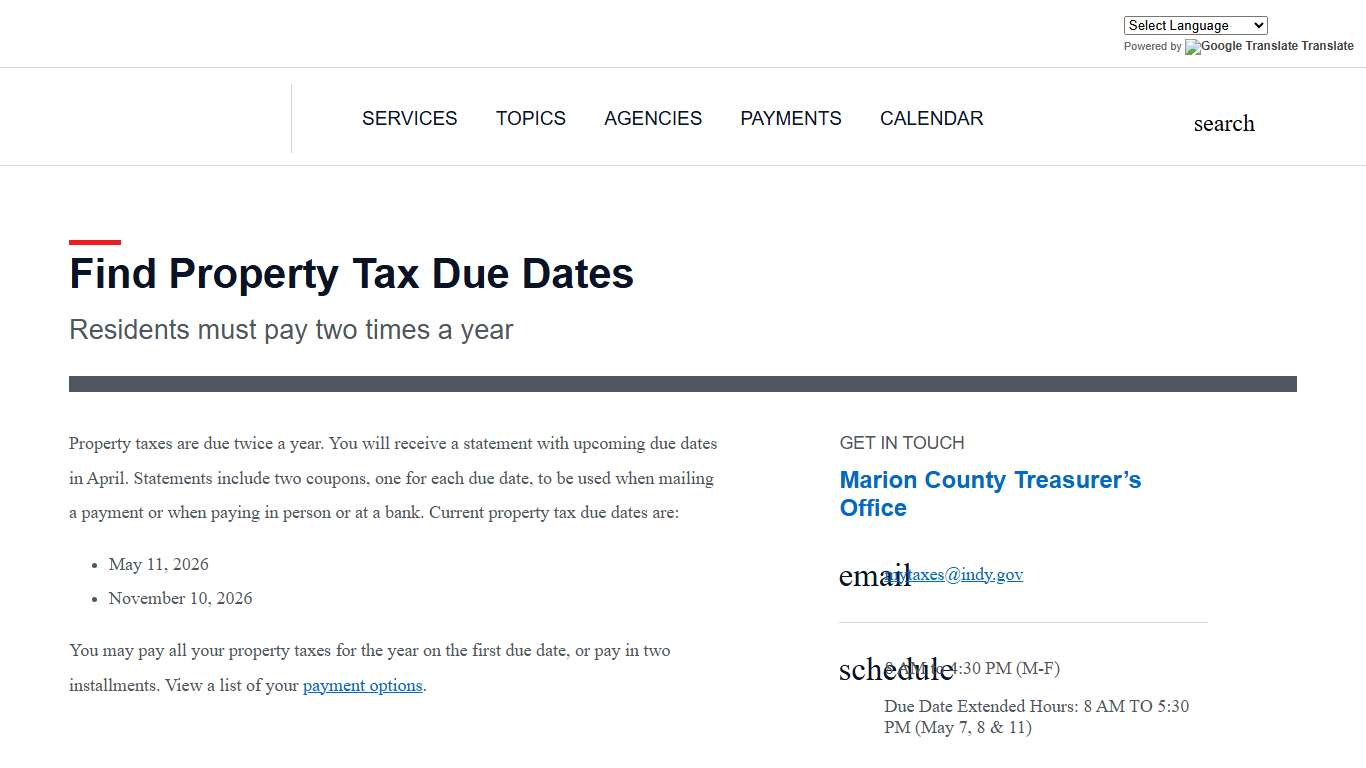

indy.gov: Find Property Tax Due Dates

Find Property Tax Due Dates Residents must pay two times a year Property taxes are due twice a year. You will receive a statement with upcoming due dates in April. Statements include two coupons, one for each due date, to be used when mailing a payment or when paying in person or at a bank.

https://www.indy.gov/activity/find-property-tax-due-dates

Treasurer's Office / Vanderburgh County

Welcome to the Vanderburgh County Treasurer's Office Our Mission is to uphold the honesty and integrity of this office and to treat every taxpayer with courteous and professional service. We are committed to provide as much information as possible about our office through this web site.

https://www.evansvillegov.org/county/department/index.php?structureid=28